How to Get Your 529 Money Back Without Penalties: A Complete Guide

A 529 plan offers tax-advantaged savings for education expenses, with earnings typically exempt from federal and state taxes when used for qualified education costs. Here's what you need to know about managing these accounts effectively.

Graduate in blue cap and gown

Understanding 529 Plans

A 529 plan, or qualified tuition program (QTP), allows tax-free growth for education savings. While federal law establishes the basic framework, individual states control specific features like investment options and tax benefits.

These accounts can be used for:

- College expenses

- K-12 tuition (up to $10,000 annually)

- Student loan repayment (up to $10,000 lifetime)

- Graduate school costs

- Qualified education expenses

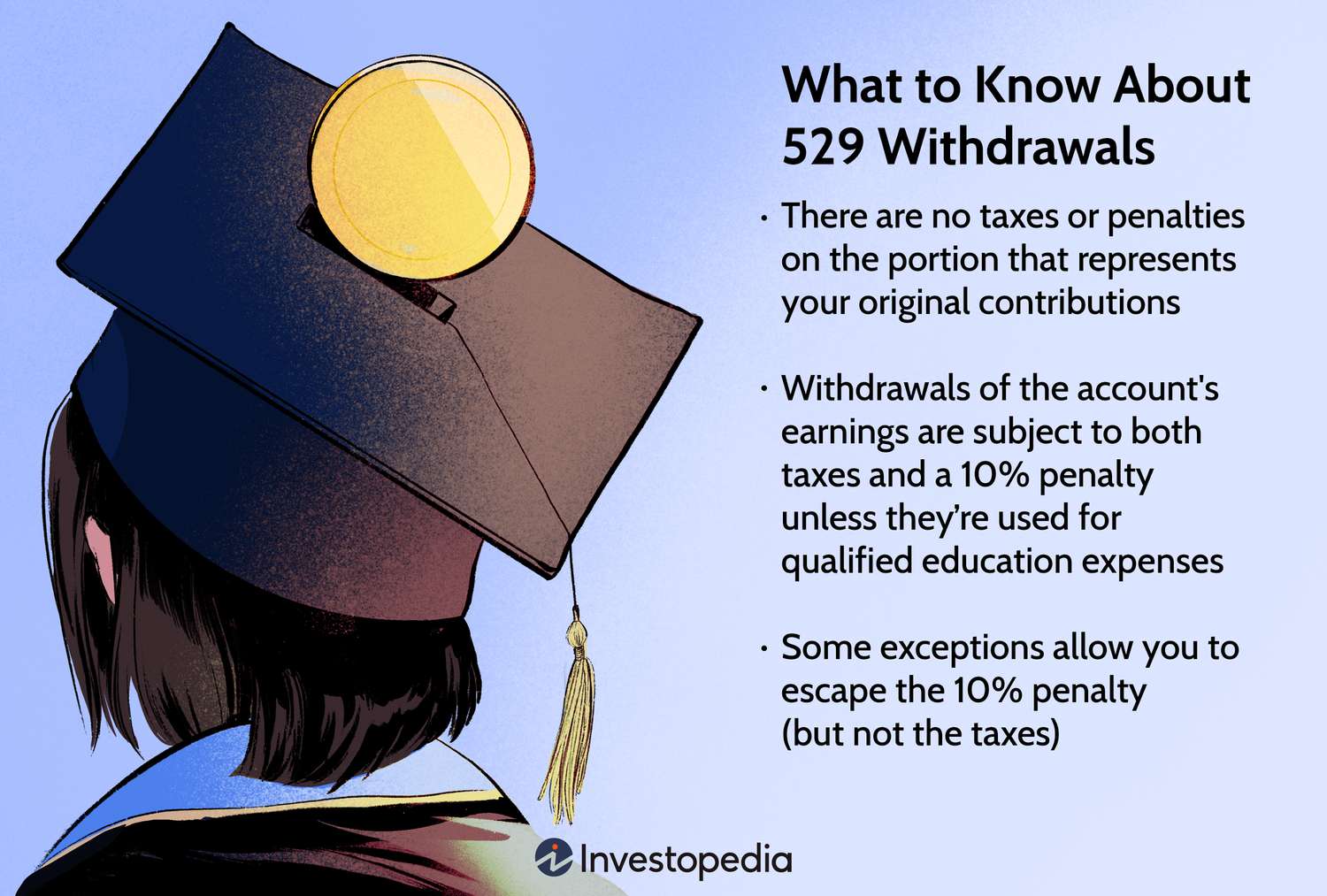

Non-Qualified Withdrawals

When using 529 funds for non-qualified expenses:

- Contributions can be withdrawn tax-free

- Earnings portion faces income tax and 10% penalty

- Distributions are allocated proportionally between contributions and earnings

Penalty-Free Withdrawal Exceptions

The 10% penalty doesn't apply when:

- The beneficiary dies or becomes disabled

- The beneficiary attends a U.S. military academy

- Education expenses were already taxed due to tax credits (AOTC or LLC)

- The beneficiary receives tax-free educational assistance

New Benefits and Options

Recent legislation allows:

- Rolling over up to $35,000 into a Roth IRA (if account is 15+ years old)

- Transferring funds to ABLE accounts for disabled beneficiaries

- Using funds for various educational purposes beyond traditional college expenses

Educational Assistance Exception

If a beneficiary receives tax-free educational assistance:

- Withdrawals up to the awarded amount avoid the 10% penalty

- Income taxes still apply to earnings

- Best practice: Withdraw funds in the same calendar year as the assistance

- Maintain detailed records of distributions and timing

The tax advantages and flexibility of 529 plans make them valuable tools for education savings, even when circumstances change. Understanding withdrawal rules and exceptions helps maximize these benefits while minimizing potential penalties.

Related Articles

Stagflation: Understanding Its Impact on Stocks and Real Estate